Chúng tôi kiến tạo cơ hội mở ra tương lai thịnh vượng

TCBS cung cấp một danh mục sản phẩm tài chính ưu việt cho khách hàng lựa chọn theo nhu cầu tích lũy và đầu tư khác nhau.

Và dành những điều tốt đẹp nhất cho khách hàng

Giao dịch tại TCBS khách hàng được hưởng tối đa lợi nhuận với chính sách Zero Fee – Miễn phí giao dịch cổ phiếu, phái sinh, chứng quyền, chứng chỉ quỹ niêm yết.

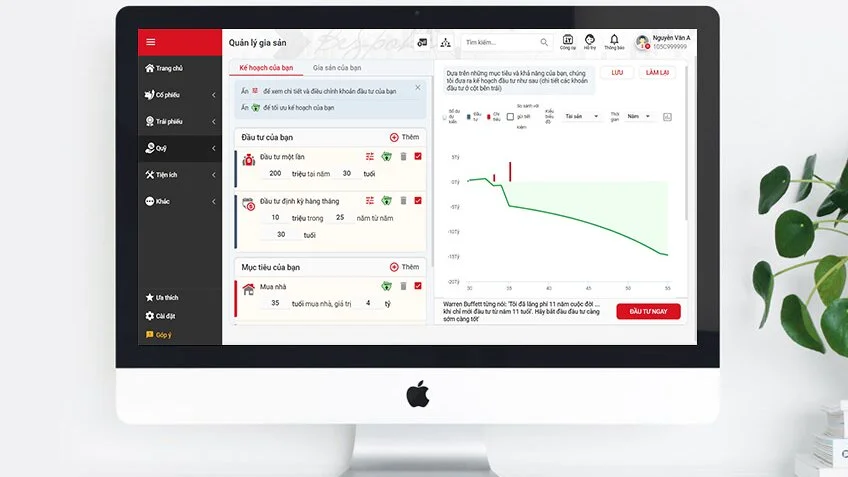

TCWealth

Robo Advisor đầu tiên được phát triển tại Việt Nam

- Công cụ online tư vấn tài chính cá nhân

- Mô tả dòng tiền chi tiết, đưa ra bức tranh tài chính toàn cảnh của mỗi cá nhân.

- Hỗ trợ người dùng lên kế hoạch đầu tư phù hợp với từng mục tiêu cụ thể trong tương lai.

- Thông minh, chuyên biệt và luôn miễn phí.

iWealth Club

Câu lạc bộ đầu tư và quản lý gia sản là nơi giao lưu cho các khách hàng quan tâm đến đầu tư và các sản phẩm chứng khoán, trái phiếu và quỹ mở.

- Tiếp cận các thông tin mới nhất về xu hướng thị trường và các sản phẩm tiềm năng.

- Kết bạn, trao đổi với các nhà đầu tư có cùng sở thích và đam mê để học hỏi thêm kinh nghiệm.

- Bàn luận về một trái phiếu đang “hot” hay chia sẻ các thông tin hay về quản lý gia sản.

- Tham khảo ý kiến các chuyên viên phân tích đầu tư và doanh nghiệp của Techcom Securities và Techcom Capital.

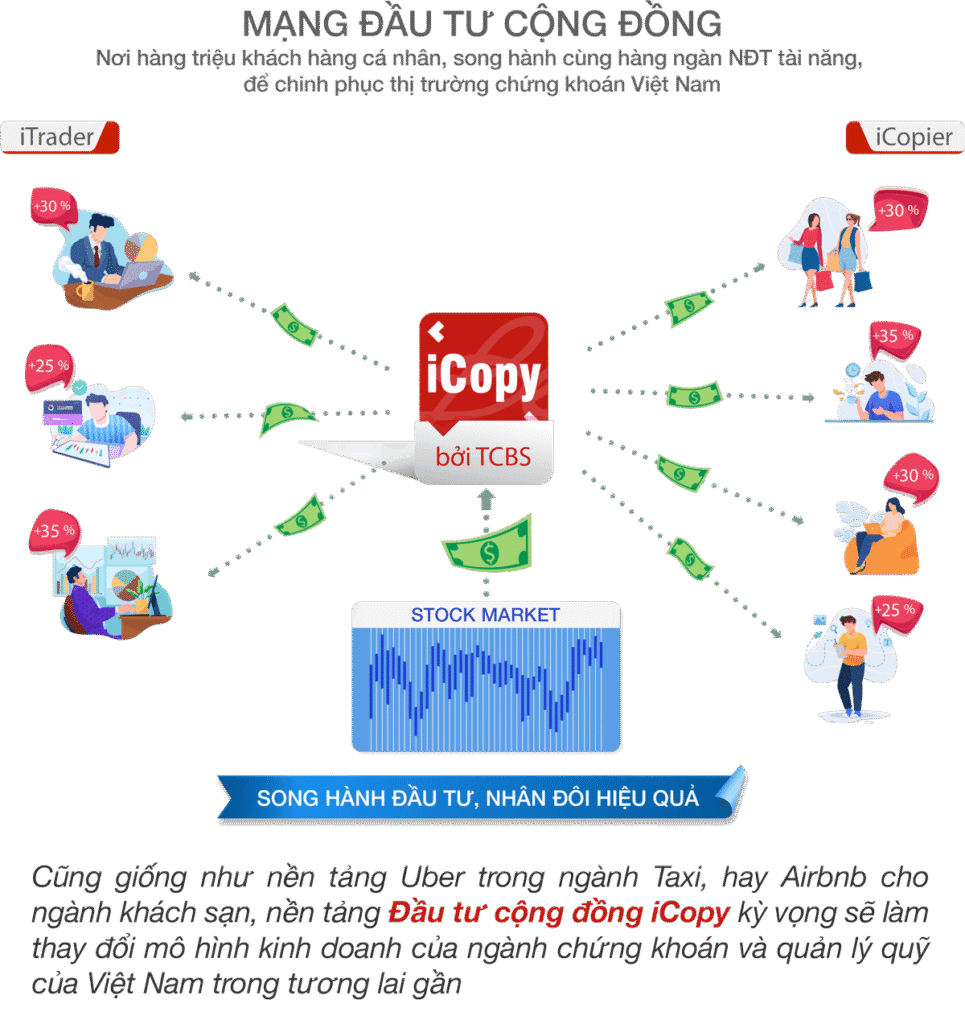

iCopy

Nền tảng đầu tư cộng đồng Social Investing đầu tiên của Việt Nam – Nơi hàng triệu khách hàng cá nhân, song hành cùng hàng ngàn Nhà đầu tư tài năng, để chinh phục thị trường chứng khoán Việt Nam

- Được tiếp cận và gợi ý danh sách các Nhà đầu tư tài năng (iTrader) tại TCBS

- Được xem hiệu quả đầu tư và danh mục của các Nhà đầu tư tài năng (iTrader)

- Được sao chép (Copy) các GD mua bán cổ phiếu, và hưởng lợi nhuận như Nhà đầu tư tài năng (iTrader) mà mình chọn

- Linh hoạt lựa chọn và thay đổi một hoặc nhiều Nhà đầu tư tài năng (iTrader) bất kỳ lúc nào

- Trải nghiệm dễ dàng, thuận tiện chỉ với 1 nút Sao chép

Các giải thưởng tiêu biểu của TCBS

TCBS là công ty con của Ngân hàng TMCP Kỹ Thương Techcombank. Bên cạnh việc tiên phong đem đến các giải pháp tài chính lý tưởng cho mỗi gia đình Việt Nam, chúng tôi đã, đang và cũng luôn tập trung phát triển hệ sinh thái Wealthtech toàn diện để mang lại những trải nghiệm đầu tư vượt trội cho khách hàng

Most Innovative Use of Technology – Blockchain

2025

Best Digital Wealth Management Experience

2025

Most Innovative Securities Firm in Vietnam

2024

Best Bond Advisory & Services Provider in Vietnam

2024

Best Wealthtech Application in Vietnam – TCInvest

2024

Digital Experience of the Year in Vietnam–Financial Technology Sector

2024

Best Investment & Fund Management Implementation

2024

Best Wealth Management Firm

2024

Most Innovative Blockchain Application in Securities

2024

Outstanding AI Technology Application in Vietnam

2024

Excellence in Fintech Technology Application in Vietnam

2024

… và giờ chúng tôi mang trải nghiệm chuyên nghiệp & hiệu quả đó đến với bạn!

TCWealth

Công cụ online tư vấn tài chính cá nhân

Sản phẩm

Danh mục đa dạng, ưu việt, phù hợp với mỗi cá nhân

TCInvest

Hệ thống giao dịch và quản lý sản phẩm đầu tư toàn diện